Differentiate yourself, care for your clients and provide them valuable financial tools in a single super-app. Keep your prospects and clients off of financial apps backed by lead gen marketplaces. With features including credit, budgeting tools, mortgage readiness and even real estate search FinLocker provides your clients a one-stop-shop of financial tools, under your brand. In this current environment, staying meaningfully engaged with your prospects and clients is more important than ever. Use FinLocker to help your prospective clients best be prepared to take advantage of the market as it returns.

Benefits for Bank of England Mortgage

- Customer engagement platform

- Native app (IOS & Android)

- Support journey of first time home buyer

- Top of sales funnel & prospect grooming

- Customer for life connectivity

- In app messaging to prospects and past clients

- Digital asset verification – D1C approved

- Streamlined mortgage application

Benefits for the Consumer

- Manage entire financial life in one app

- Credit score, report, alerts & monitoring

- Bank level security

- Spending analysis

- Budgeting & planning

- Savings goals

- Homeownership and mortgage education

- Property value including recently sold near you

- Real Estate search

- Document storage

- Consumer controlled data sharing

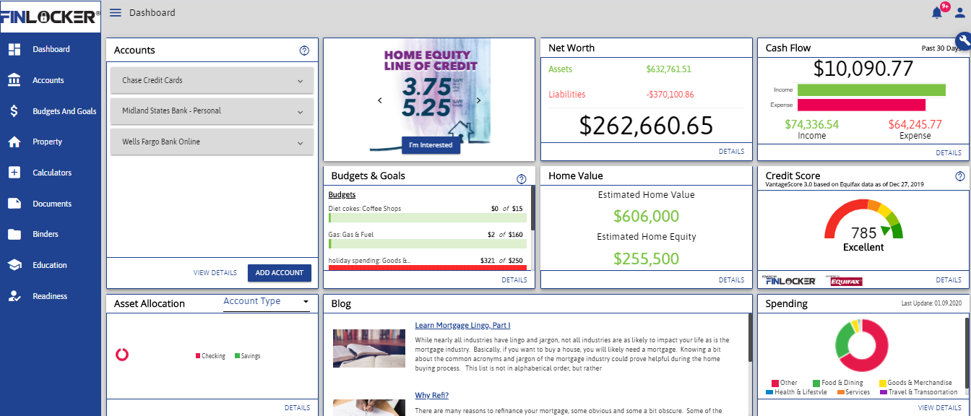

FinLocker Dashboard

Our dashboard allows consumers to see financial assets, credit score, budget, goals, property search, and home value all from one interface.

Special 2020 Offer

Yearly Subscription fee is waived (Free) for the first ten Loan Officers to JOIN. Yearly subscription includes unlimited number of active personalized Bank Of England Vaults including your Contact information for immediate loan processing and engagement.

Loan Transaction fee includes the Loan Officer accepting the lead and the simple on-time uploading of the loan application and electronic data into Encompass including FinLocker Verification of Assets.

| FinLocker Fees | Standard | BOE | FinLocker ROI | Summary |

| One-Time On Board | $299 | $149 | # of active lockers: 1000 |

LO Contact (Picture, MNLS) in vault, Engagement, Immediate Sharing, Offers |

| Yearly Subscription Fee | $799 | $499 | # of loans closed:24 | Unlimited Number of Active Lockers |

| Customer Loan Creation Fee | $175 | $125 | ROI: 2017% | Customer initiates Loan submission from their Locker, LO Accepts the Lead Data, Loan Processed |