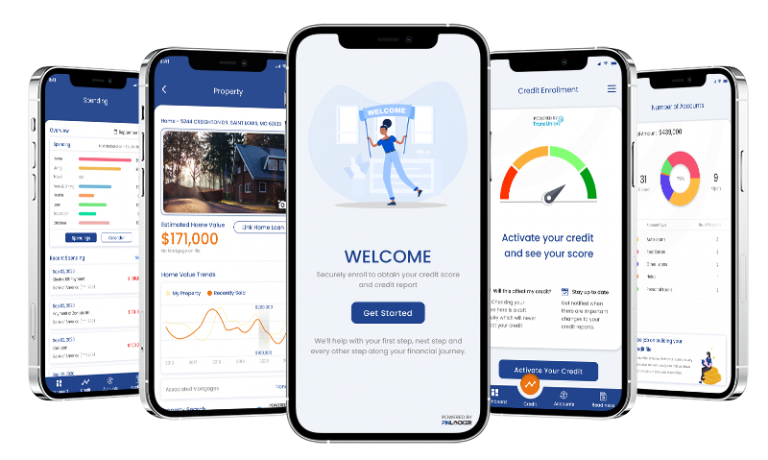

Experience how FinLocker provides consumers with a personal path to homeownership

Improve your lead to closed loan conversion

Extend your business ecosystem

Manage a larger purchase pipeline

Streamline mortgage application

FinLocker is a financial fitness platform that extends your business ecosystem with a high-tech, high-touch platform that compliments your existing tech stack.

Private-labeling the FinLocker app with your logo and brand will provide a competitive edge for lead acquisition, nurturing, and conversion.

FinLocker helps loan originators manage a larger purchase pipeline by guiding homebuyers towards mortgage readiness using the financial tools and resources they often use in other disparate apps.

Providing your private-labeled FinLocker to your leads and prospects early in your engagement will help insulate them from your competitors.

A readiness assessment perpetually analyzes the consumer’s enrolled financial data, so your borrowers will know when they are mortgage ready.

Borrowers can initiate their loan application directly from their app by sharing their enrolled financial data and stored documents. The data and documents are encrypted during transfer to the lender’s LOS, reducing the risks often associated with document procurement and streamlining the mortgage application process for all parties.

FinLocker provides consumers with a personal path to achieve homeownership and other financial goals

Manage Financial Accounts

Consolidated, real-time view of all enrolled bank accounts, credit cards, auto loan, student loan, retirement, and investment accounts.

Build and Monitor Credit

Receive your credit score, credit report and credit monitoring from TransUnion.

An interactive credit simulator with multiple create-related scenarios, takes the guesswork out of credit decisions.

FinLocker does a soft credit check, so it will never affect a consumer’s credit score.

Calculator Home Affordability

Proprietary analytical technology calculates an affordable home budget with a monthly mortgage payment that fits a consumer’s income, recommends how much they should save for their down payment and closing costs for a Conventional, FHA, and VA loan. Consumers can quickly create a goal to save for these costs in a few clicks.

Loan Readiness Assessment

Homebuyers can see where they are in the mortgage approval process in a few minutes.

The assessment shows what they need to improve to be eligible for a mortgage, including credit score, debt-to-income ratio, savings for closing costs, employment, etc.

Customized Household Budget

Create savings goals, custom budgets, and track progress in real-time to save for down payment and closing costs, pay down debt, and plan how to achieve other financial goals.

Personalized Spending Plan

The Spending Analysis categorizes each financial transaction in all enrolled accounts, so consumers can see where they are spending their income, make informed spending decisions, and identify where they can start saving.

Homeownership Education

Improve financial literacy with resources and videos on managing credit, auto loans, insurance, and homeownership, including mortgage terms, mortgage programs, and the mortgage process.

Real Estate

Start home search in the app.

See recently sold homes in neighborhood.

Track home value and equity after purchase.

Start Mortgage Application

Consumers can Contact Lender (you) directly from the app at any time, or start their mortgage application by securely sharing their financial data and documents saved in the app.

Improve the financial well-being of those who matter most

Compliment your CRM and POS tech stack with a high tech, high touch white-labeled financial well-being platform reflecting your brand and value proposition for lead acquisition, curation, and conversion.

Consumer permissioned data and proprietary analytics drive FinLocker to deliver personalized financial insights with patented technology that enables mortgage lenders and mortgage originators to efficiently manage their customer pipeline and provide seamless transaction experiences that create customers for life. Mortgage servicers use their private-label FinLocker to improve customer retention, cross-sell products, and reduce loss mitigation risk with borrowers experiencing financial hardships.